TransUnion Marketing Opt Out Guide

If you’ve noticed an increase in junk mail, spam calls, or targeted ads, there’s a good chance your information is being shared by major credit bureaus like TransUnion. Fortunately, you can opt out of their marketing lists with a few simple steps. Doing so helps you cut down on unsolicited offers and gives you more control over your personal data.

What is TransUnion?

TransUnion is one of the three major credit reporting agencies in the United States, alongside Equifax and Experian. While its core business involves compiling consumer credit reports, TransUnion also maintains extensive consumer databases that it uses for marketing purposes. Through its marketing division, TransUnion sells lists of consumer information—such as names, addresses, credit-related insights, and demographic data—to businesses for advertising and solicitation.

Marketers use this data to send prescreened credit card offers, insurance solicitations, and other targeted advertising. Although this practice is legal, it often feels invasive for consumers, since it’s done without direct consent.

By opting out, you can request that your information be excluded from TransUnion’s marketing databases, significantly reducing the volume of unsolicited credit and insurance offers you receive. This opt-out does not affect your actual credit report or scores—it only removes you from marketing and solicitation lists.

How to Remove Your Information from TransUnion Marketing (Step by Step)

Step 1: Visit the official opt-out page: https://www.optoutprescreen.com. This site is operated jointly by Equifax, Experian, Innovis, and TransUnion. Scroll down to the blue “click here to opt out or opt in” button.

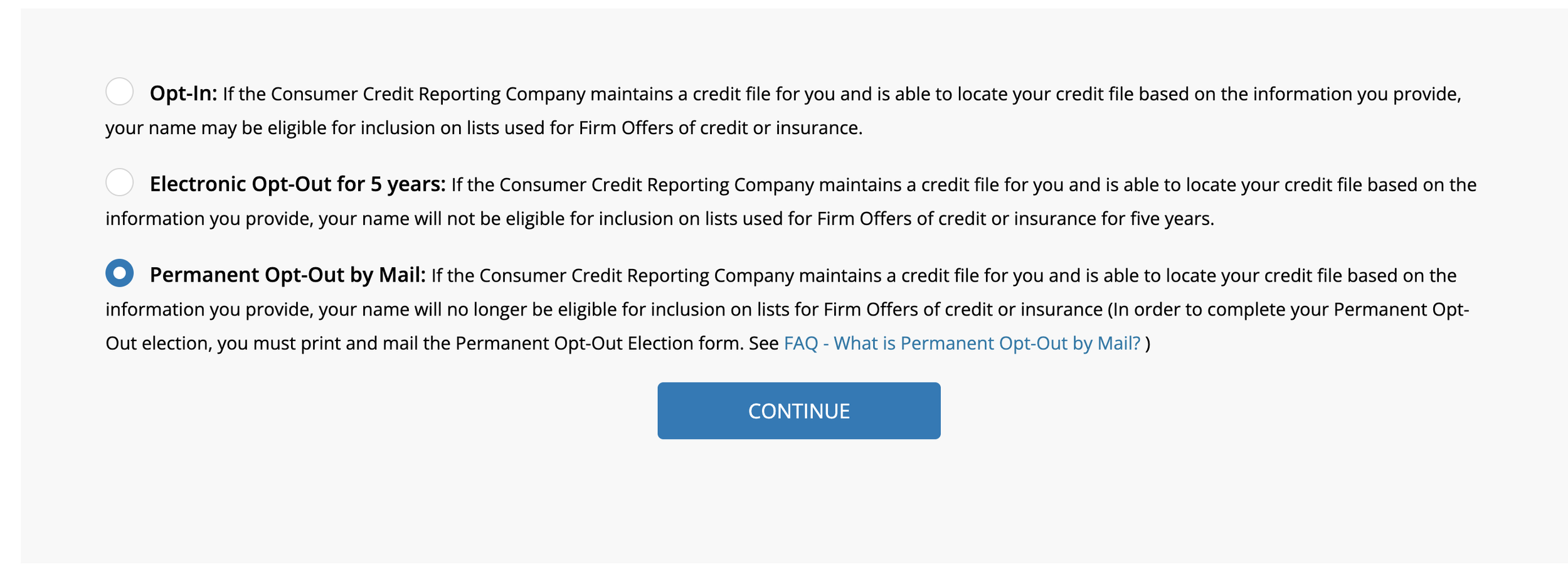

Step 2: Choose your preference: (1) Opt out for 5 years online, or (2) Opt out permanently by printing, signing, and mailing the permanent opt-out form. In this guide, we’ll be going through the permanent opt out method.

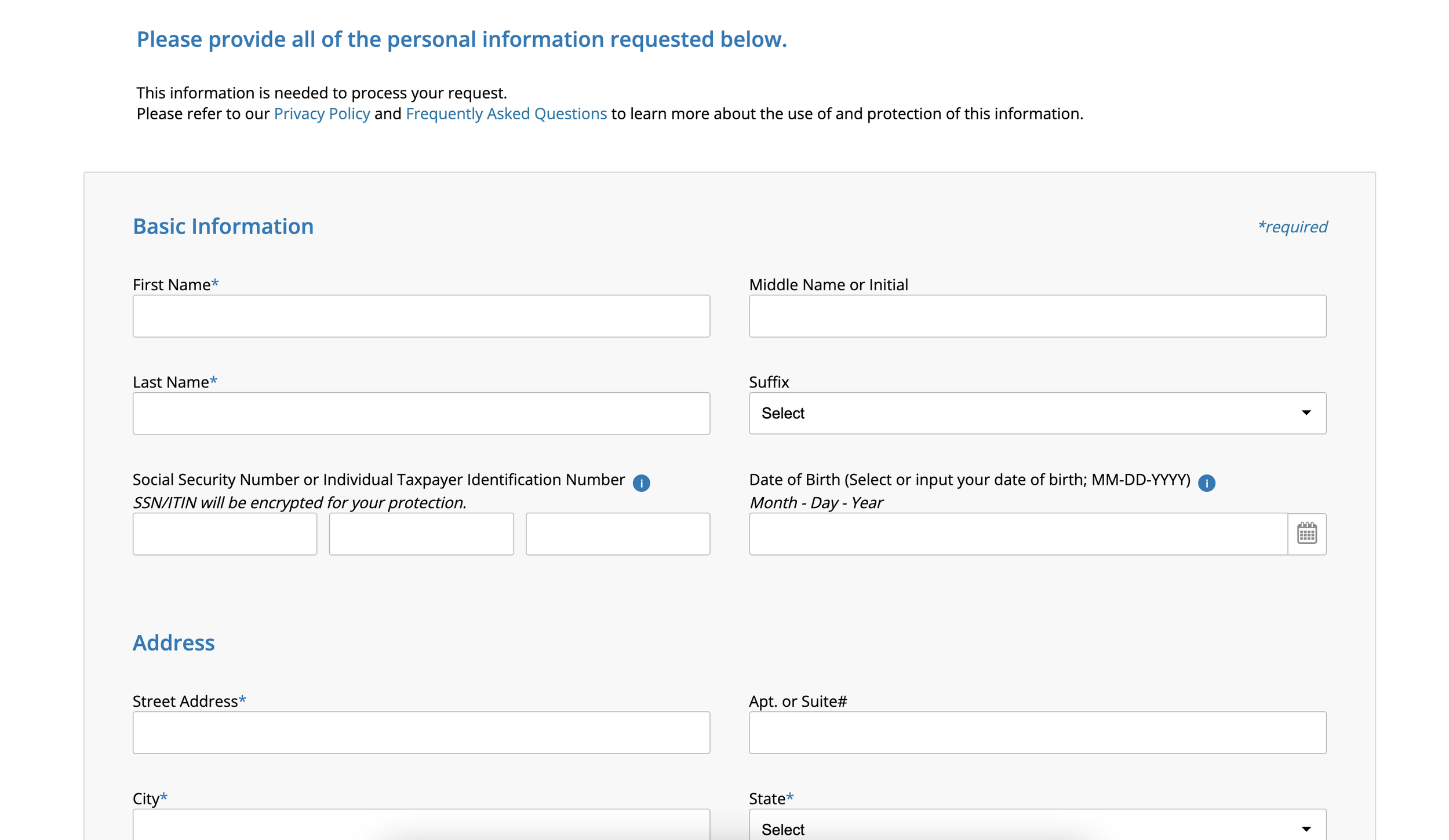

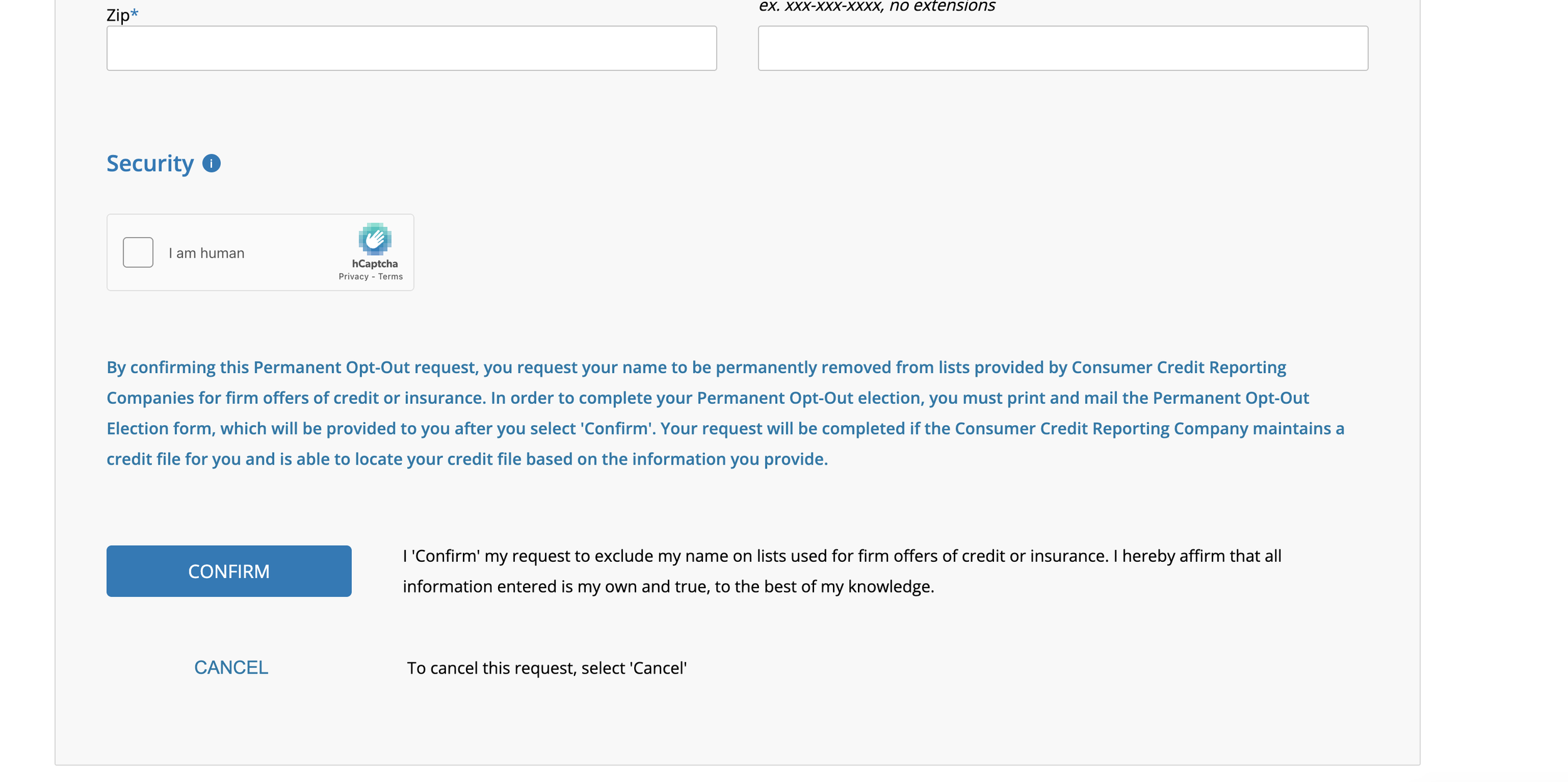

Step 3: Fill out the required information, then click ‘confirm’.

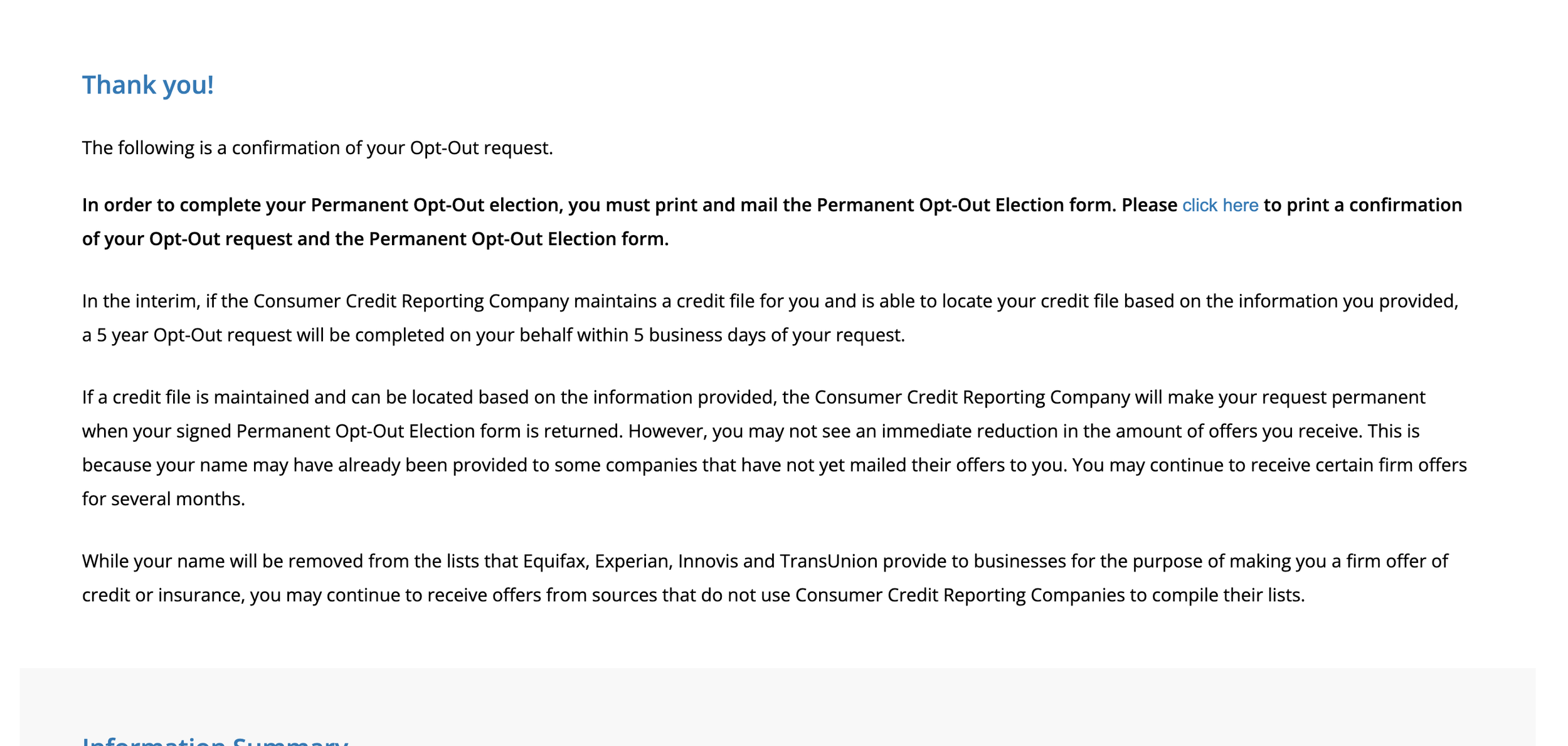

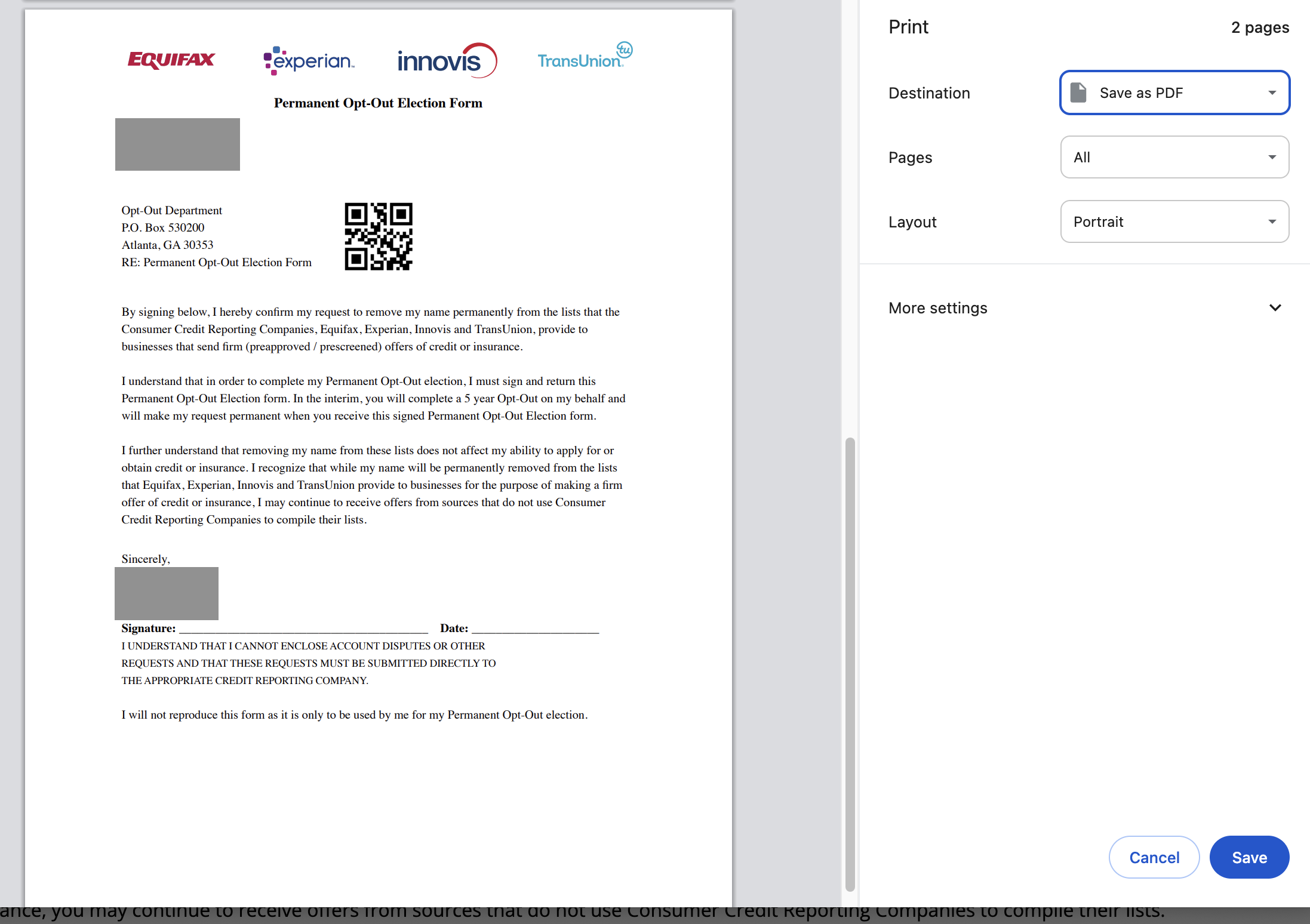

Step 4: Next, you’ll be redirected to a confirmation page. Print the confirmation of the opt-out request and permanent opt-out election form.

Step 5: Print the following form. Mail the signed permanent opt-out form to:

Opt-Out Department

P.O. Box 530200

Atlanta, GA 30353

Then, you’re finished!

Set & Forget Privacy

Continuous monitoring, zero chores.

Keep spam calls and creepy lookups down with ongoing people-search scans.

- Finds re-listings fast

- Re-files removals for you

- Clean progress reports showing what’s been sent

Results depend on each site’s policy & processing time.

How Long Does TransUnion Take to Remove Your Info?

When you submit an opt-out request through OptOutPrescreen, it usually takes 5–7 business days for TransUnion and other credit bureaus to process your request. However, you may still receive prescreened credit and insurance offers for up to 30 days while the update propagates through various marketing systems. If you choose the permanent opt-out, your mailed form must first be received and processed before your request is finalized.

Don’t Forget to Opt Out of the Other Credit Bureaus

Removing yourself from TransUnion’s marketing lists is a powerful step, but it doesn’t cover all of the major credit bureaus. Equifax, Experian, and Innovis also share consumer information for prescreened offers and targeted advertising.

To complete the process, follow these guides next:

Working through these additional removals will cut down on unwanted mail and solicitations from all major credit bureaus, giving you more control over your personal data.

Tips & Warnings

Opting out of TransUnion’s marketing lists does not affect your credit score or ability to apply for loans.

If you move or change your name, you may need to submit a new opt-out request.

For the permanent opt-out, don’t forget to physically sign and mail the form—unsigned forms will not be accepted.

Keep a copy of your confirmation or mailed request for your records.

TransUnion Marketing Important Links:

One opt-out down. Hundreds more to go.

People-finder and data broker sites frequently re-add your information and new sites appear all the time. Vanish Me scans, removes, and keeps monitoring automatically—so your data stays off these sites.

- Automated removals across hundreds of brokers

- Continuous re-checks to stop info from resurfacing

- New brokers tracked and added to coverage

Live example metrics from a typical removal cycle.