Experian Marketing Data Sharing Opt Out Guide

Experian doesn’t just manage credit reports—it also runs one of the largest consumer marketing databases in the world. If you’d rather not have your personal details sold for advertising, you can submit an opt-out request to stop Experian from sharing your information. The process can be done manually through their privacy portal.

What is Experian Markeing?

Experian Marketing Services is a division of Experian that compiles extensive consumer data, including demographics, lifestyle information, purchasing behavior, and household details. This data is then sold to marketers, advertisers, and analytics companies that want to target consumers more precisely. Unlike credit reporting—which is federally regulated and tied to lending—Experian’s marketing arm focuses on monetizing consumer profiles for non-credit purposes. That means your address history, interests, and even inferred behaviors may be packaged into a marketing dataset without you realizing it. Fortunately, U.S. privacy laws like the California Consumer Privacy Act (CCPA) give you the right to opt out of the “sale” or sharing of personal data. Submitting an opt-out request tells Experian not to use your personal information for marketing or advertising audiences. While it won’t delete your credit file or remove financial reporting obligations, it can significantly reduce how widely your personal details are circulated in the advertising ecosystem.

How to Remove Your Information from Experian Marketing (Step by Step)

Step 1: Go to the Experian Marketing Privacy Request page. Click “Get Started”

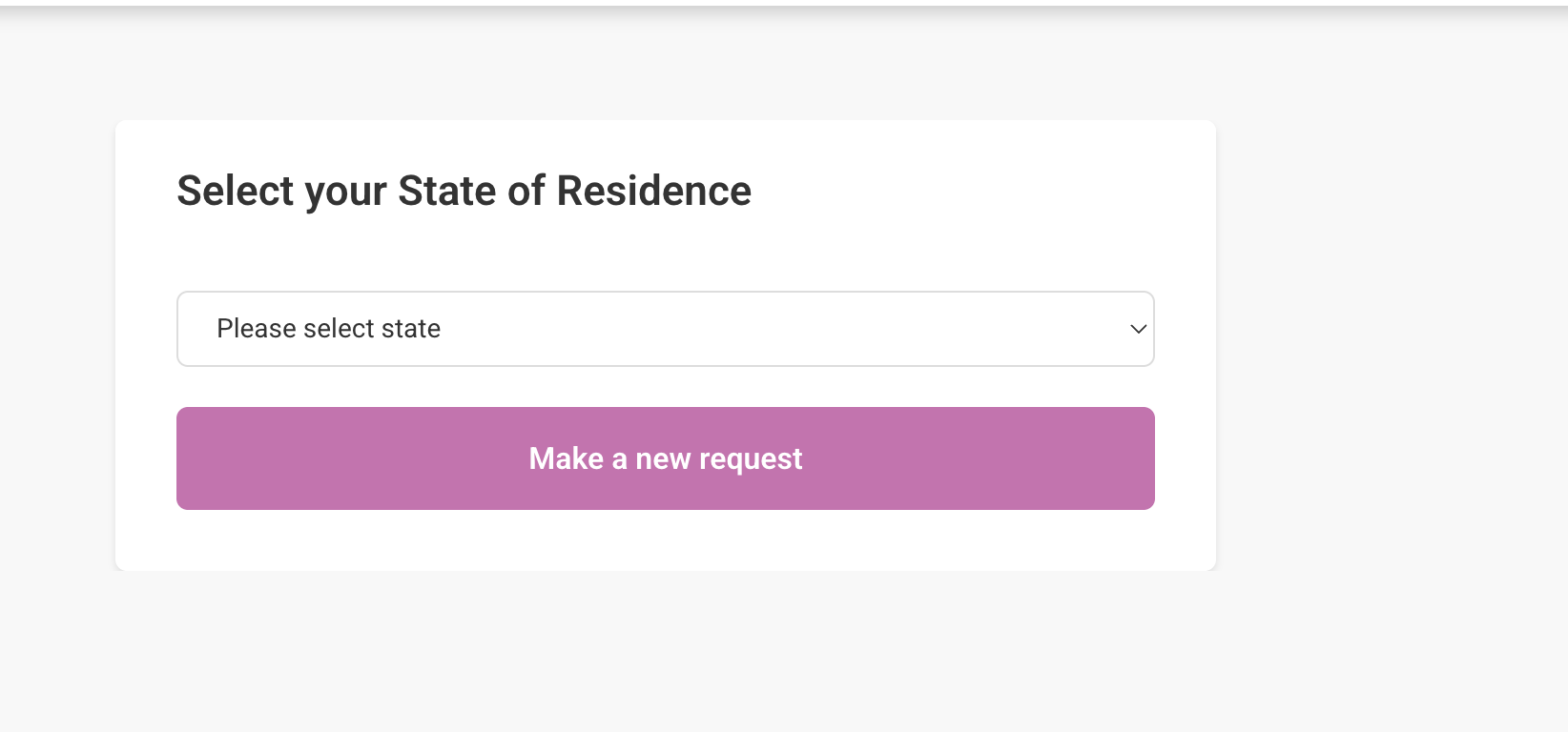

Step 2: Select your state and click “make a new request”

Step 3: Make the applicable selections and click “continue”

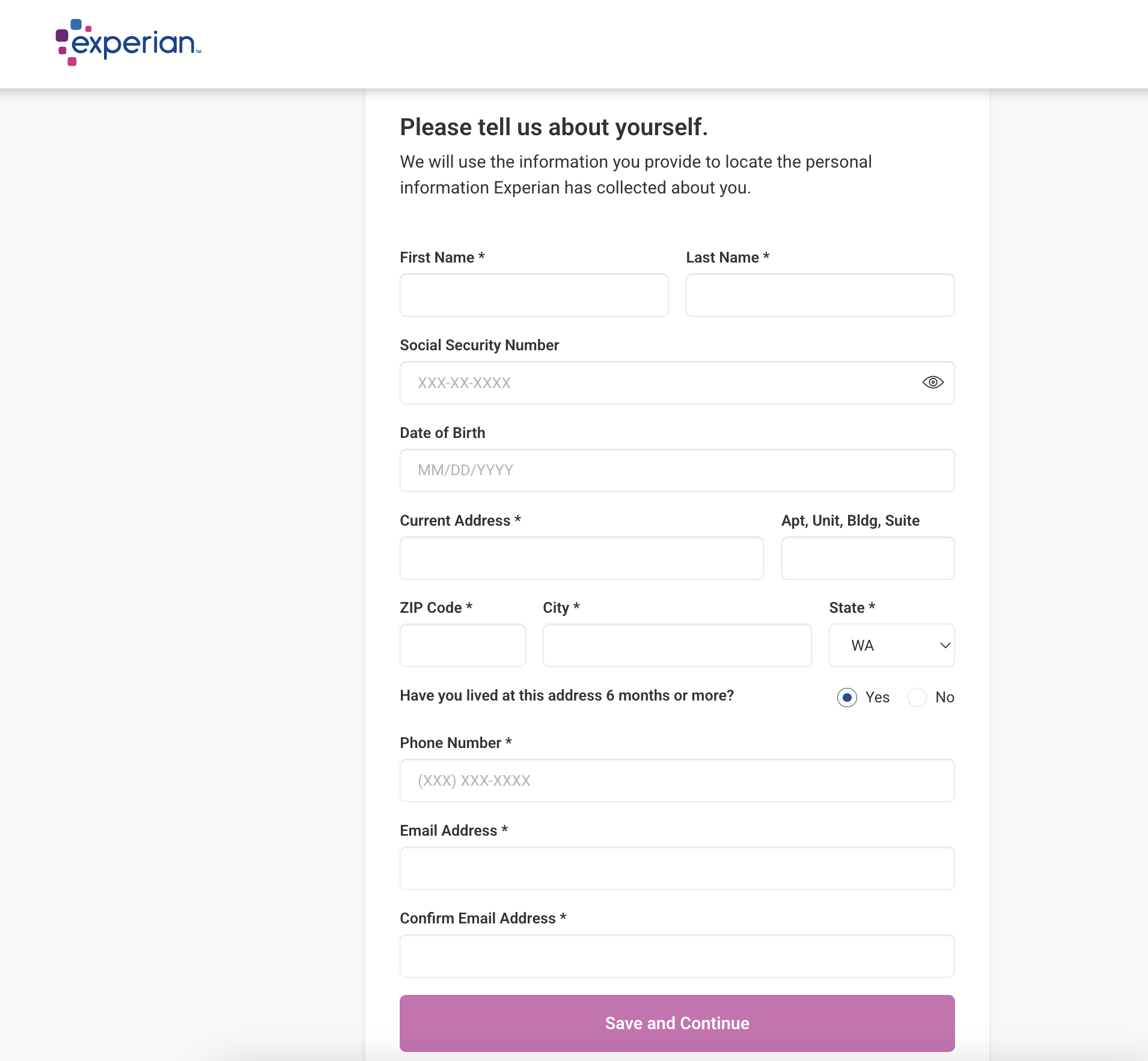

Step 4: Fill out your personal information, then select “save and continue”

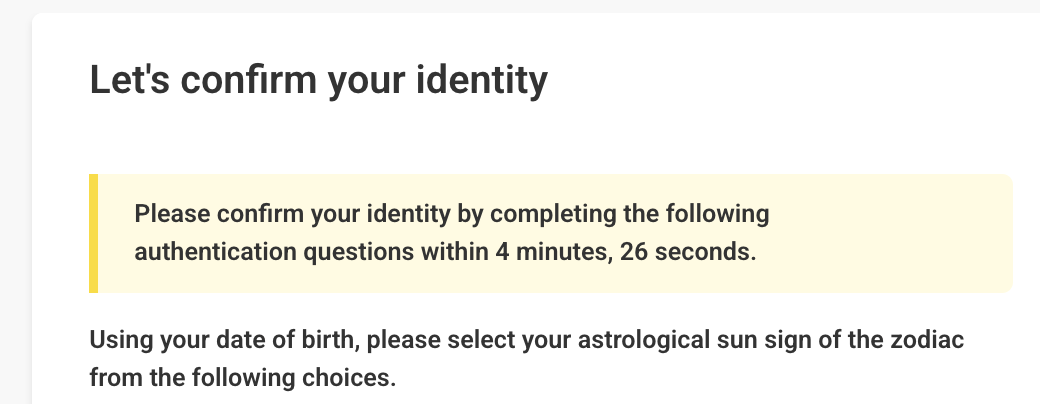

Step 5: Answer the identity confirmation questions, then click “continue”

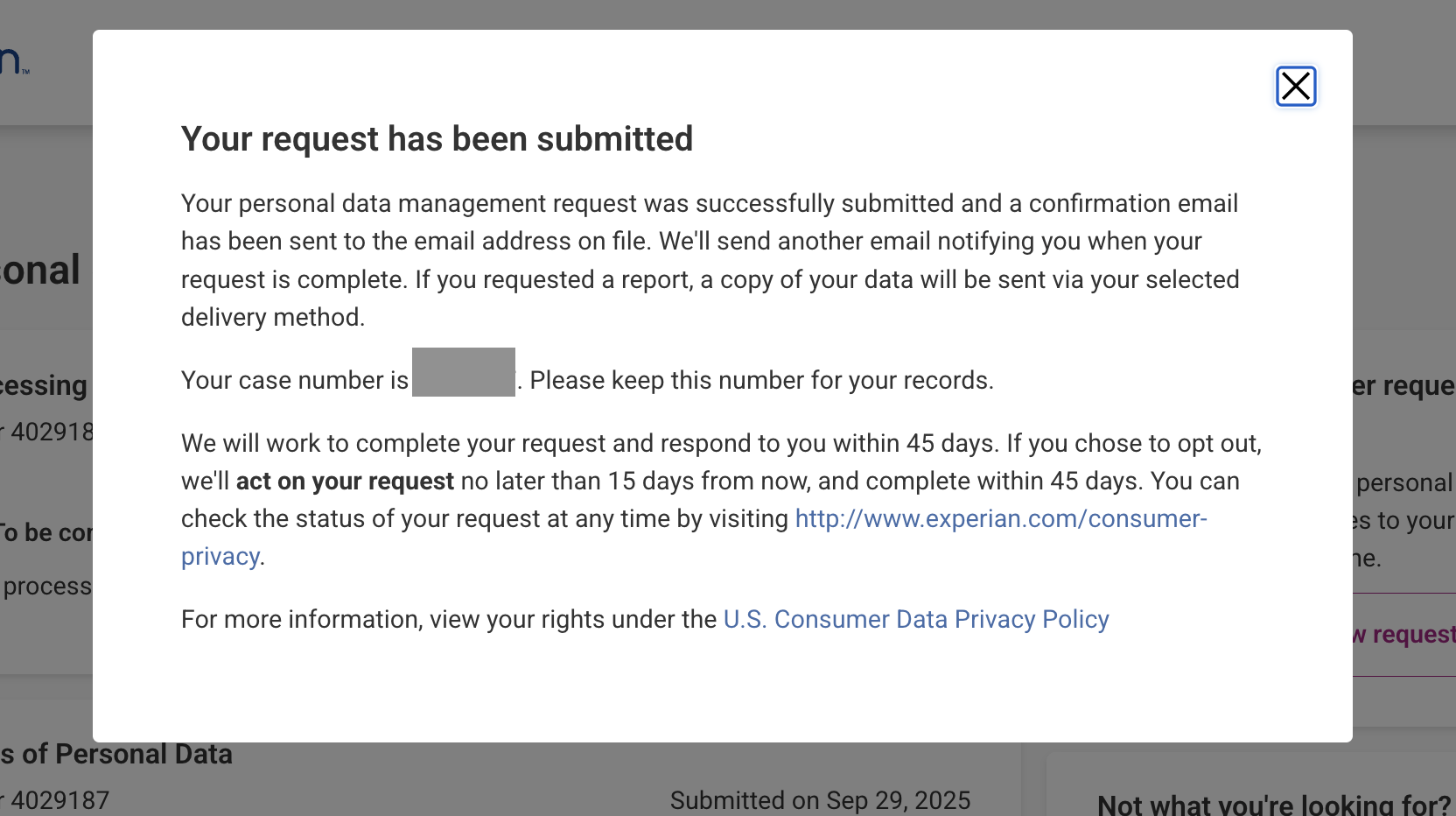

Step 6: Then, you’re done! Your request will have been submitted to the Experian team.

Set & Forget Privacy

Continuous monitoring, zero chores.

Keep spam calls and creepy lookups down with ongoing people-search scans.

- Finds re-listings fast

- Re-files removals for you

- Clean progress reports showing what’s been sent

Results depend on each site’s policy & processing time.

How Long Does Experian Marketing Take to Remove Your Info?

Experian usually processes opt-out requests within 30 to 45 days, though most requests are completed sooner if verification is straightforward. Once your request is processed, Experian Marketing should stop selling or sharing your personal information for advertising purposes. Keep in mind that your data will still be retained in your regulated credit file for lending purposes—it’s only the marketing side that’s affected. Because Experian updates and refreshes consumer datasets frequently, you may want to periodically re-check your status or rely on an automated opt-out service to maintain long-term suppression.

Your Data May Still Be Visible on Other Sites

Opting out of Experian Marketing is a strong step toward protecting your privacy, but it’s only one part of the process. Most people find their information listed on dozens of data broker sites, not just one.

To continue reducing your digital footprint, we recommend checking out these other guides next:

Each guide walks you through the opt-out process step by step so you can take control of your information across multiple sites. To save yourself time, sign up for Vanish Me to automate the data broker removal process.

Experian Important Links:

One opt-out down. Hundreds more to go.

People-finder and data broker sites frequently re-add your information and new sites appear all the time. Vanish Me scans, removes, and keeps monitoring automatically—so your data stays off these sites.

- Automated removals across hundreds of brokers

- Continuous re-checks to stop info from resurfacing

- New brokers tracked and added to coverage

Live example metrics from a typical removal cycle.