Equifax Data Sharing/Marketing Opt Out Guide

Equifax isn’t just a credit bureau—it also collects and shares personal information for marketing and data analytics. If you’d prefer not to have your details sold or shared, you have the right to opt out under consumer privacy laws. You can complete the process yourself directly with Equifax - we’ll show you how below.

What is Equifax?

Equifax is one of the three major credit reporting agencies in the U.S., best known for maintaining consumer credit files and generating credit reports. In addition to its role as a credit bureau, Equifax also monetizes consumer data by selling access to datasets for marketing, insurance, and analytics purposes. That means your personal information—such as demographic data, purchasing behavior, and address history—may be shared with third parties even outside of lending or credit contexts. Privacy laws such as the California Consumer Privacy Act (CCPA) give consumers the right to opt out of this kind of “sale” or sharing of personal information. Exercising this right won’t delete your credit file or remove your financial history from Equifax’s reporting obligations, but it does restrict how the company can use your data for non-credit purposes. For individuals concerned about data privacy, opting out is an important way to reduce the spread of personal information beyond essential credit reporting.

How to Remove Your Information from Equifax Marketing (Step by Step)

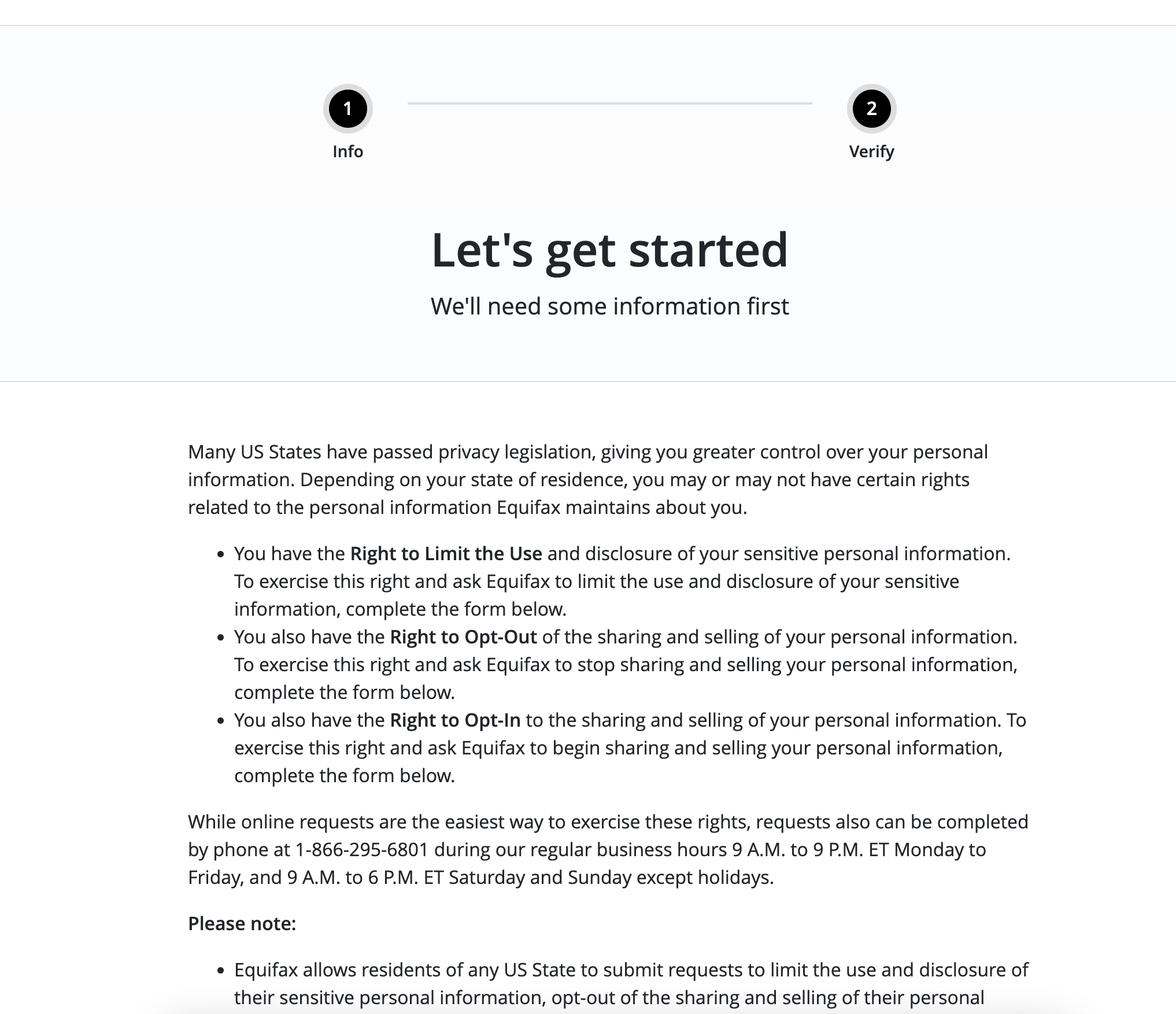

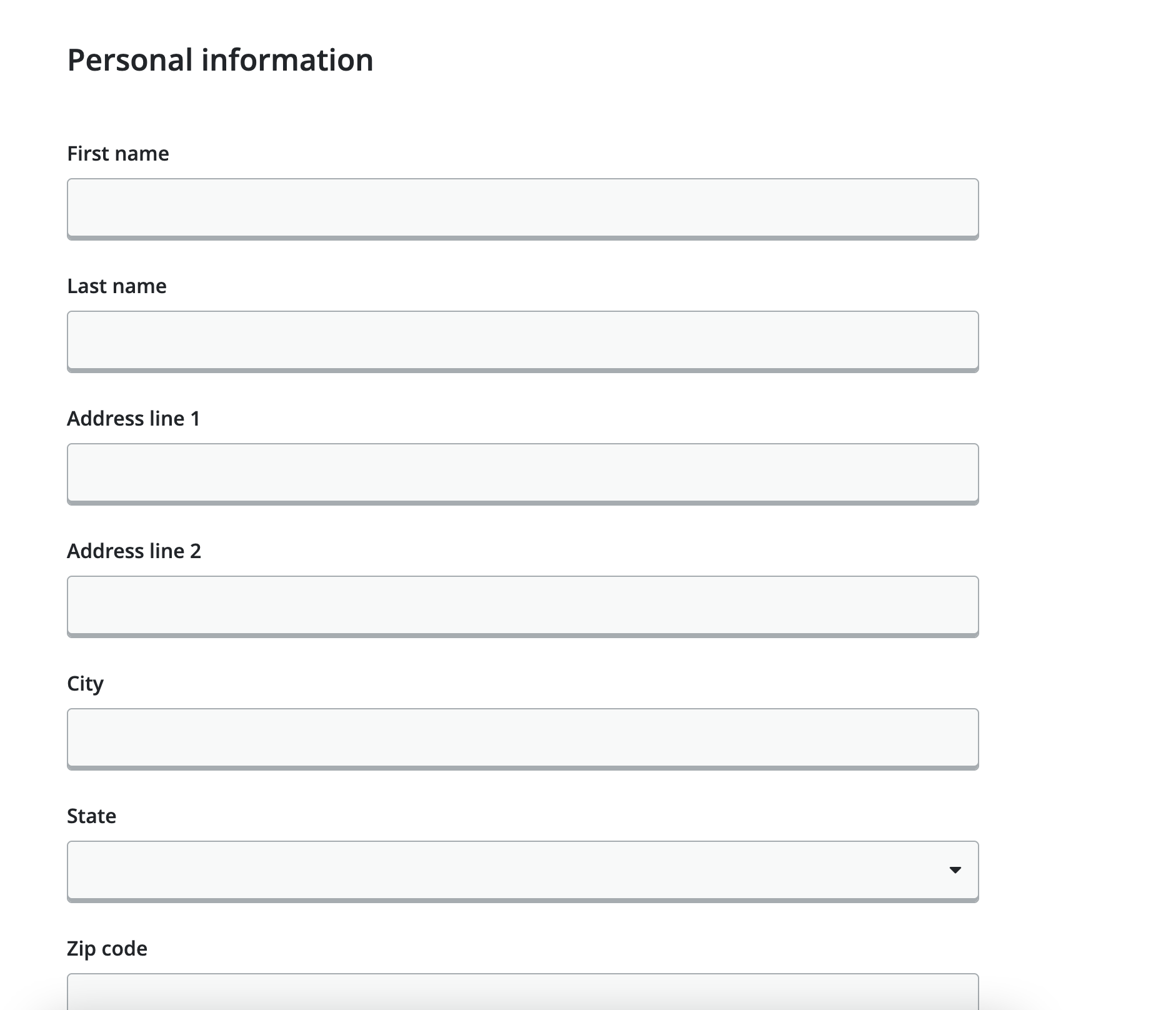

Step 1: Visit the official Equifax Privacy Rights Request Form. Fill it out and click the button to go to the next page.

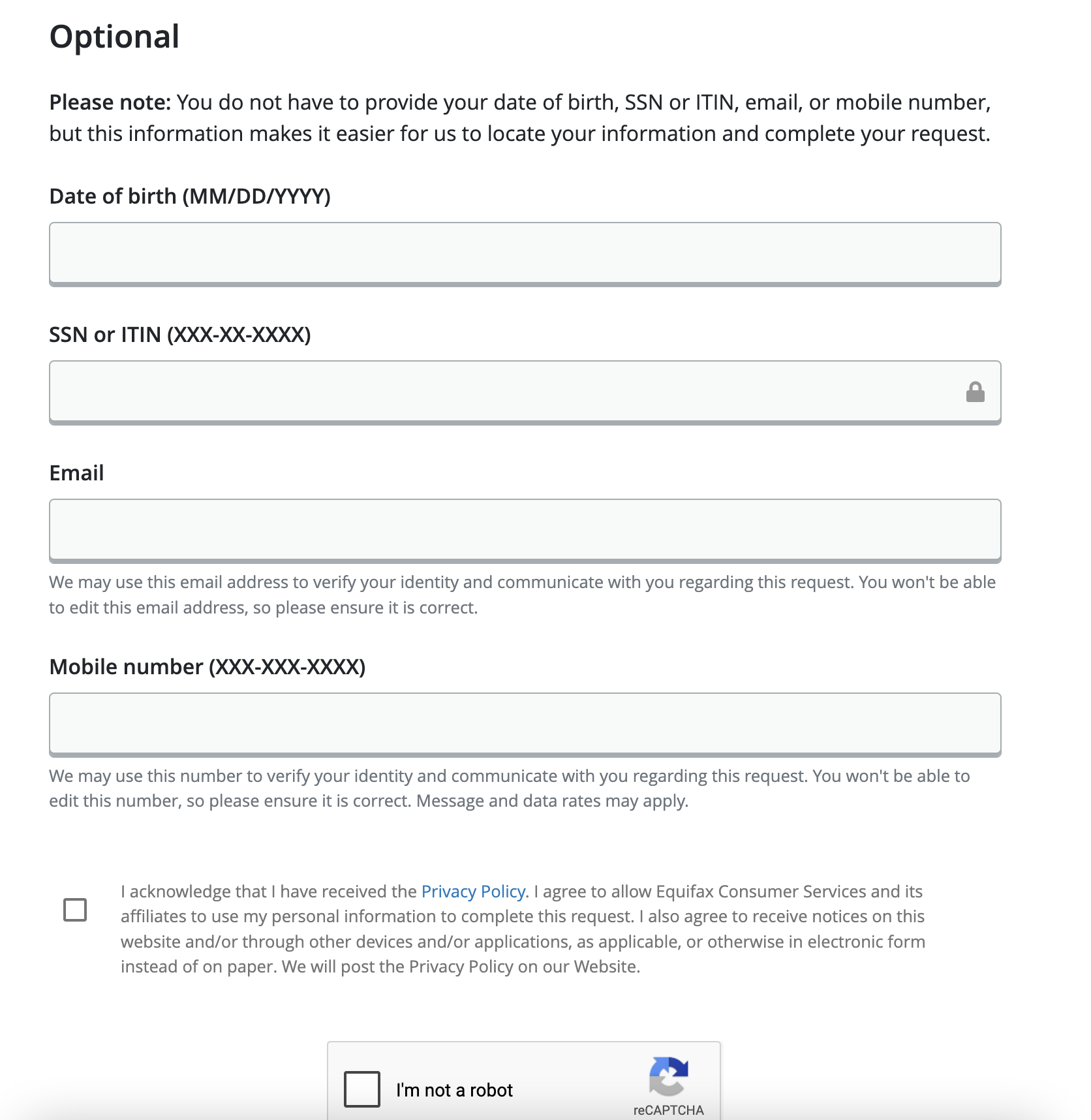

Step 2: Select the “Right to Opt Out” section, then click “continue”

Step 3: Then you’re done!

Set & Forget Privacy

Continuous monitoring, zero chores.

Keep spam calls and creepy lookups down with ongoing people-search scans.

- Finds re-listings fast

- Re-files removals for you

- Clean progress reports showing what’s been sent

Results depend on each site’s policy & processing time.

How Long Does Equifax Take to Remove Your Info?

Once submitted, Equifax typically processes opt-out requests within 15 to 45 days, depending on the complexity of verification. During this time, they may contact you to confirm your identity or request additional information. After your request is complete, Equifax should stop selling or sharing your personal data for marketing purposes. However, your information will still remain in your credit file for reporting obligations.

Your Data May Still Be Visible on Other Sites

Opting out of Equifax Marketing is a strong step toward protecting your privacy, but it’s only one part of the process. Most people find their information listed on dozens of data broker sites, not just one.

To continue reducing your digital footprint, we recommend checking out these other guides next:

Each guide walks you through the opt-out process step by step so you can take control of your information across multiple sites. To save yourself time, sign up for Vanish Me to automate the data broker removal process.

Equifax Quick Links:

One opt-out down. Hundreds more to go.

People-finder and data broker sites frequently re-add your information and new sites appear all the time. Vanish Me scans, removes, and keeps monitoring automatically—so your data stays off these sites.

- Automated removals across hundreds of brokers

- Continuous re-checks to stop info from resurfacing

- New brokers tracked and added to coverage

Live example metrics from a typical removal cycle.